Based on Basic Policy on Internal Control System, the Company and its consolidated subsidiaries regularly reevaluate risk awareness and evaluate the status of efforts to reduce risks, and strive to take measures to prevent risk occurrence and minimize the impact if a risk does occur.

Basic Policy on Internal Control System

2. Matters concerning the establishment of systems to ensure the appropriateness of operations

We have identified five key risks to our consolidated management that could have a significant impact on investor decisions: "risks relating to responding to changes in the business environment," "risks relating to safety management," "risks relating to compliance," "risks relating to working styles and securing human resources," and "risks associated with long-term, widespread disruption to the flow of people."

Please refer to the following page for details of significant Risks of Business Operations.

*Excluding the Setagaya Line and Kodomo-no-Kuni Line

*Excluding Kodomonokuni Line

As with other important management issues, the Company and its consolidated subsidiaries identify and evaluate significant risks to the Company and its consolidated subsidiaries from a consolidated management perspective in accordance with Basic Policy on Internal Control System, discuss risk management policies, etc. at the Management Meeting, and report to the Board of Directors.

Please refer to the "Corporate Governance" page for specific details about our structure.

In accordance with Basic Policy on Internal Control System as set forth below, the effectiveness of the oversight by the Board of Directors is regularly reviewed.

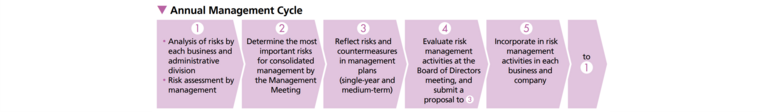

the Company and its consolidated subsidiaries regularly reassess risk awareness and evaluate the status of risk mitigation efforts using the process below, and strive to take measures to prevent risks from occurring and minimize their impact if they do occur.

Specifically, each year, the head of each division is made responsible for visualizing the impact and probability of occurrence of "anticipated risks" in the business operations of each consolidated company and division of the Company, and creating a "risk map" in which the risks are plotted on a map to prioritize the business. From this, risks that require focused mitigation are selected as "major risks" based on the probability of manifestation and the impact if they do manifest, and a "risk report" reflecting the major risks for each business is created in conjunction with the formulation of management plans, and reported to the Management Meeting and the Board of Directors.

Our company has established the following terms of office for Audit & Supervisory Board Member Members:

The term of office of Audit & Supervisory Board Member shall be until the conclusion of General Shareholders Meeting relating to the last business year ending within four (4) years after their election.

In addition, the Company has a policy for Audit & Supervisory Board Corporate Auditors to determine the policy for dismissal or non-reappointment of the appointed accounting auditor. Audit & Supervisory Board judges the appropriateness of the audit method and results, including the appropriateness of the status of performance of duties, audit system, independence and expertise, etc. Then, proposals regarding the appointment, dismissal and non-reappointment of the accounting auditor are submitted to General Shareholders Meeting for resolution.

the Company and its consolidated subsidiaries are anticipating the impact of climate change on our business, strengthening our risk management, and working to integrate our responses to risks and opportunities into our business strategies.

Please refer to he following page for details on climate change risks and our management system.

the Company and its consolidated subsidiaries operate businesses that are closely related to the daily lives of many customers, including transportation, real estate estate, and Life Service Business. In the event of a major earthquake or other disaster, we are committed to business continuity (BC) management with the goal of ensuring safety while continuing business operations and quickly restoring operations.

For details on risks to business continuity and our crisis management system, please refer to the following page.

In FY2022, there was one compliance violation that had a significant impact on the management of our group at our head office, domestic and overseas bases, and domestic and overseas subsidiaries.

In February 2023, Tokyu Agency Co., Ltd. and one of its former executives were criminally charged by the Japan Fair Trade Commission and indicted by the Tokyo District Public Prosecutors Office in connection with a bid-rigging case (violation of the Antimonopoly Act) related to the Tokyo 2020 Olympic and Paralympic Games (trial ongoing as of the end of September 2023). The Company takes this matter very seriously and is working to further strengthen compliance with the Antimonopoly Act and governance at the Company and its consolidated subsidiaries, including the company in question. The Company's president has issued a top message to each consolidated company, and has conducted comprehensive emergency inspections under the guidance of experts to check the possibility of similar cases occurring at the Company and its consolidated subsidiaries. In July 2023, a seminar was held for the presidents and other management of the Company and its consolidated subsidiaries subsidiaries to raise awareness of the Antimonopoly Act. The company in question established an Independent Compliance Verification Committee in May of the same year and is currently analyzing the cause and formulating measures to prevent recurrence. In the future, the Company will strive to further strengthen compliance by conducting more comprehensive awareness-raising activities through seminars and other means, as well as by promoting the development of measures to prevent recurrence throughout the Company and its consolidated subsidiaries.

Please refer to the following page for information on how we respond to internal and external reports to reduce risks.